By now, most investors understand that markets do not move in straight lines. What feels different heading into 2026 is not uncertainty itself, but the number of forces intersecting at once. Economic signals are mixed. Policy changes are reshaping tax decisions. Major stock indexes around the world produced double-digit returns for the year. For individuals and families, the question is no longer how to react, but how to plan through it with clarity and purpose.

At moments like this, the value of a comprehensive financial plan becomes especially clear. Investing matters, but it is only one aspect of a much larger strategy that must evolve alongside your life and the broader financial landscape.

Watch to learn more about our Outlook

Watch our Annual Outlook Webinar on-demand to hear directly from our team on planning priorities for the year ahead, upcoming tax changes from the One Big Beautiful Bill Act, market opportunities and risks, and more.

Watch nowThis Environment Demands More

Over the past several years, strong equity market performance has carried many portfolios forward. That success, while welcome, can sometimes obscure underlying risks. Concentration in a narrow group of market leaders, uneven exposure across accounts, and outdated assumptions about taxes or retirement timelines often go unnoticed during favorable markets.

As we look ahead in 2026, planning conversations are shifting. The questions are nuanced: Are financial plans resilient? Are there opportunities to make the most of today’s tax rules before or as they change? Do portfolios still reflect long-term goals, not just driven by recent performance?

These are the right questions. They reflect a broader truth that wealth is not static, and neither is the environment surrounding it. And the exact aspects our Financial Consultants are addressing in client discussions. Now, more than ever, it’s a balance between financial planning and an active investment strategy.

Retirement Is No Longer a Finish Line

One of the most important planning realities shaping 2026 is longevity. Retirement today often spans two or even three decades. That extended horizon places greater emphasis on sustainable savings.

Contribution limits for retirement accounts have increased for the year, creating meaningful opportunities for those still working to grow their nest-egg.

Account Type |

2026 Contribution Limits |

|---|---|

IRA, Roth IRA |

$7,500 |

401(k) 403(b), 457 |

$24,500 |

Source: IRS.gov

For many households, especially those in peak earning years, maximizing these vehicles is about preserving optionality in the future. Thoughtful coordination between taxable, tax-deferred, and tax-free accounts can meaningfully influence how retirement income is generated years from now.

Retirement planning is no longer a question of when you stop working. It is a question of how you maintain control and confidence across an extended and evolving phase of life.

Taxes Are a Planning Variable, not a Once-a-Year Task

With the introduction of the One Big Beautiful Bill Act in summer 2025, the tax landscape has shifted, and the changes have introduced both complexity and opportunity. New rules affect deductions, charitable strategies, and how different forms of income are treated. For high-net-worth families, these changes reinforce the importance of proactive planning rather than reactive filing.

Capital gains, in particular, deserve careful attention. The difference between long-term and short-term treatment, as well as the timing of gains across years, can materially affect after-tax outcomes. Incremental realization, strategic loss harvesting, and coordination with broader income streams, all play a role in managing taxes within your plan.

Thinking About Portfolios in 2026

The new year will bring its own surprises, opportunities, and challenges for capital markets. For us, at the outset of 2026, several important questions stand out:

- Will artificial intelligence yield tangible, economy-wide benefits quickly enough for companies and investors to justify the ongoing boom in AI spending?

- Can pro-business policies, such as tax incentives and deregulation, lead to stronger economic activity by encouraging increased investment and hiring?

- Is the labor market experiencing a temporary soft patch, or is a more sustained downturn on the horizon?

Maintaining a diversified approach to portfolio construction is as important as ever. Diversification enables investors to be positioned to benefit from favorable outcomes to these key questions, while also helping to mitigate the risks associated with excessive exposure to adverse developments.

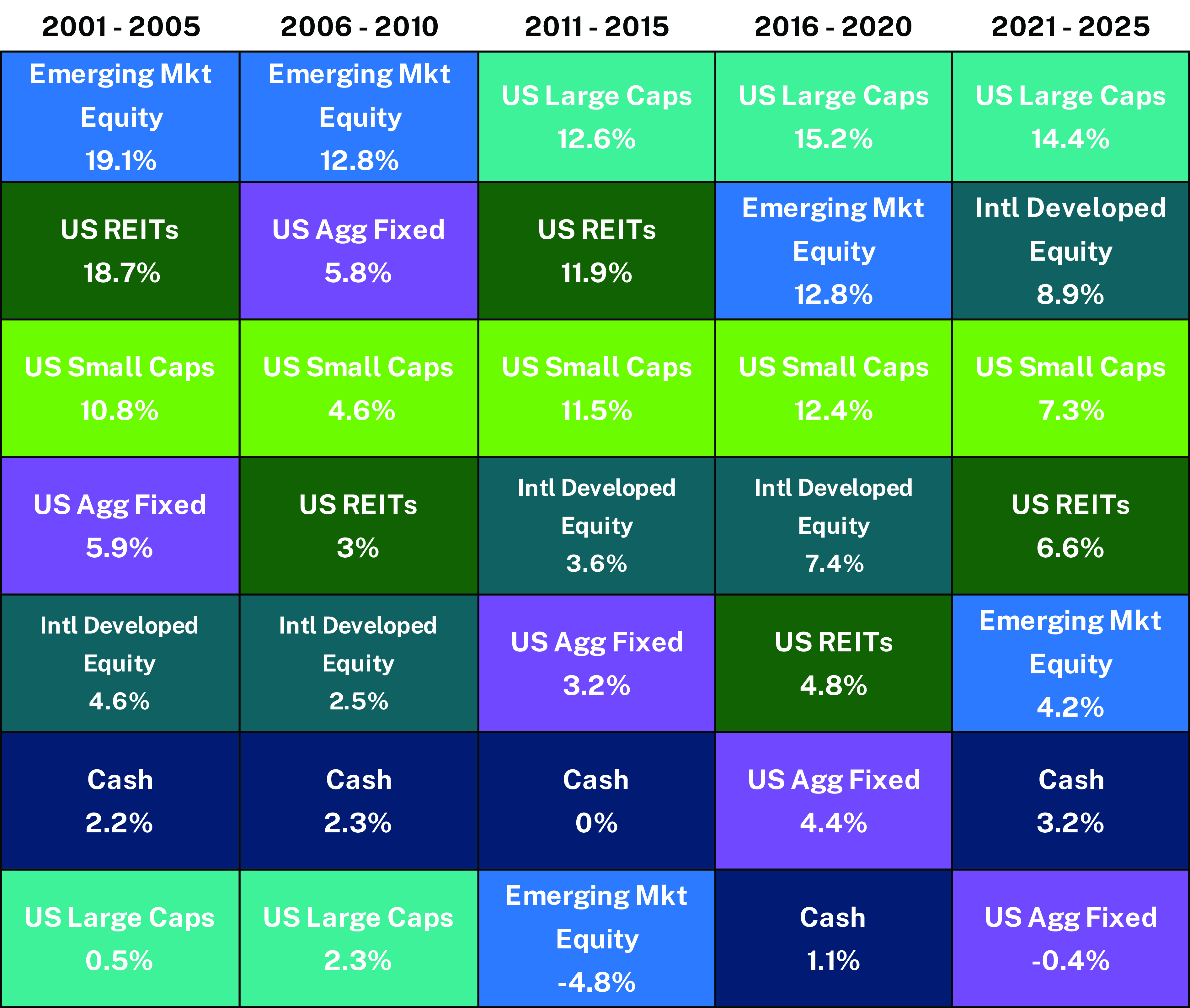

History reminds us that no asset class wins every month, quarter, year – or every 5 years.

The Power of Diversification

5 - Year Annualized Total Returns

Analysis: Manning & Napier. Source: Bloomberg (01/01/2001 – 12/31/2025).

Looking Ahead

As we enter 2026, perhaps the most important takeaway is that planning is not a one-time event. It is an ongoing dialogue. Life changes. Markets change. Laws change. A plan that adapts alongside those shifts is far more valuable than one that sits untouched.

Regular check-ins allow for proactive adjustments before they become urgent. They create space to revisit assumptions, refine strategies, and ensure that each decision fits within your broader goals. In a world that feels increasingly complex, that alignment is often what clients value most.

No outlook can predict the future with certainty. What it can do is provide context, perspective, and a framework for decision-making. As we move into 2026, the environment calls for intention over reaction and planning over prediction, so this is a moment to step back, take stock, and ensure that your financial strategy reflects not just where markets have been, but where your life is headed.

We're here to help

We can review your financial plan and ensure you’re employing the right strategies to reach your goals. We’ll help create a personalized, well-rounded financial plan that includes elements like tax management, retirement planning, estate planning, charitable gifting strategies, and more.

We’ll also stress test your plan by running a thousand simulations based on return forecasts and risk expectations, providing you with a range of different outcomes. At the end of the trials, you will receive a probability of success for your plan.

Get started with a free consultationPlease consult with an attorney or a tax or financial advisor regarding your specific legal, tax, estate planning, or financial situation. The information in this article is not intended as legal or tax advice.

The data presented is for informational purposes only. It is not to be considered a specific stock recommendation. Unless otherwise noted, analysis provided by Manning & Napier. Past performance does not guarantee future results.

US Large Caps: The S&P 500 Total Return Index is an unmanaged, capitalization-weighted measure comprised of 500 leading U.S. companies to gauge U.S. large cap equities. The Index returns do not reflect any fees or expenses. The index accounts for the reinvestment of regular cash dividends, but not for the withholding of taxes. Index returns provided by Bloomberg.

US Small Caps: The S&P SmallCap 600 Index is an unmanaged, capitalization-weighted measure of 600 small U.S. companies with market capitalizations between $300 million and $1.4 billion listed on the on the New York Stock Exchange and the NASDAQ stock market.

Intl Developed Equity: The MSCI EAFE Index (EAFE) is a free float-adjusted market capitalization index designed to measure large and mid-cap representation across 21 Developed Markets countries (excluding the U.S. and Canada). The Index returns do not reflect any fees or expenses. The Index is denominated in U.S. dollars. The Index returns are net of withholding taxes. They assume daily reinvestment of net dividends thus accounting for any applicable dividend taxation. Index returns provided by Intercontinental Exchange (ICE).

Emerging Mkt Equity: The MSCI Emerging Markets Index (MSCI EM) is a free float-adjusted market capitalization index designed to measure large and mid-cap representation across 24 Emerging Markets countries. The Index returns do not reflect any fees or expenses. The Index is denominated in U.S. dollars. The Index returns are net of withholding taxes. They assume daily reinvestment of net dividends thus accounting for any applicable dividend taxation. Index returns provided by Bloomberg.

US REITs: The MSCI U.S. Real Estate Investment Trust (REIT) Index is a free float-adjusted market capitalization index that is comprised of equity REITs that are classified in the Equity REITs Industry under the GICS® Real Estate sector. The MSCI U.S. REIT Index is a subset of the MSCI USA Investable Market Index (IMI) which captures large, mid, and small-cap securities. The Index returns do not reflect any fees or expenses. The Index is denominated in U.S. dollars. The Index returns are net of withholding taxes. They assume daily reinvestment of net dividends thus accounting for any applicable dividend taxation. Index returns provided by Bloomberg.

US Agg Fixed: The Bloomberg U.S. Intermediate Aggregate Bond Index is an unmanaged, market-value weighted index of U.S. domestic investment-grade debt issues, including government, corporate, asset-backed and mortgage-backed securities, with maturities greater than one year but less than ten years. Index returns do not reflect any fees or expenses. Index returns provided by Intercontinental Exchange (ICE).

Cash: The FTSE 3-Month Treasury Bill Index is an unmanaged index based on 3-Month U.S. treasury bills. The Index measures the monthly return equivalents of yield averages that are not marked to market. The Index returns do not reflect any fees or expenses. Index returns provided by Intercontinental Exchange (ICE).

Index data referenced herein is the property of S&P Dow Jones Indices LLC, a division of S&P Global Inc., its affiliates ("S&P", Bloomberg), MSCI, its affiliates ("MSCI"), Bloomberg Finance L.P. and its affiliates ("Bloomberg"), ICE Data Indices, LLC, its affiliates ("ICE Data") and/or their third party suppliers and has been licensed for use by Manning & Napier. S&P, MSCI, ICE Data, and Bloomberg and their third party suppliers accept no liability in connection with its use. Data provided is not a representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and none of these parties shall have any liability for any errors, omissions, or interruptions of any index or the data included therein. For additional disclosure information, please see: https://go.manning-napier.com/benchmark-provisions.